FOREX MARKET HOURS WHICH FOREX MARKET IS OPEN/CLOSED NOW? Before we look at the trending…

Why trade using bots in Forex?

Forex Robot Trading

Forex Robot trading, also regarded as algorithmic trading, has indeed been widely used in capital markets over the last decades. The growing use of robot trading has brought significant benefits to the quality of transactions. Several researchers have built trading Forex Robot that can replicate their trading tactics, and have proposed that these robots will manage to make money ahead of human traders. Nevertheless, their efficiency is usually not as good as human traders. Two reasons could contribute to this trade failure:

(1) Systems cannot replicate all human behavior.

(2) Many robots are over-sensitive, which can reduce their efficiency. Therefore, it is crucial to test the performance and flexibility of trading robots to solve these problems.

Effective Mechanisms for Robot Forex Trading

The management of the Fund is part of an investment plan. In Forex trading, traders often use fund management to set up funds for each deal. As a result, the amount of capital is more significant in the trade cycle. Like the asset management feature, the risk control feature can allow traders to set a stop and a loss threshold that can be closed automatically. The research feature is used to build a Forex trading approach since it can make decisions to catch trading opportunities.

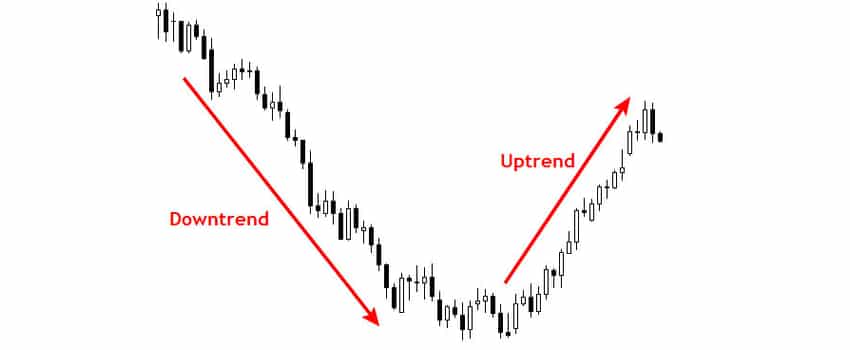

However, most trading Forex Robot do not follow all the ever-changing business conditions. The foreign exchange market is diverse and tends to shift through three types of business environments: up, down, and sideways. Trade robotics cannot manage these dynamic movements by evaluating historical evidence. The risk management feature controls the whole purchase process. If the trade has been terminated, the research feature will recalculate and check for new trading opportunities.

Nevertheless, trading robots will have some characteristics of rapid response, high success rate, and low risk, which is why Forex robots should be used.

Quick response when the signal is given

Forex Trading Robot is a continuous process that trades and handles accounts on the Forex trading website. As a result, trading robots will replace humans and automatically automate this behavior. Forex Day Trading in 2011 reveals that, relative to human traders, trading robots can catch more short-term trading benefits. It is because the default Forex Robot trading process will minimize the reaction time required by human traders to assess the possible price and position orders. Response time is, therefore, an essential criterion for the assessment of trading robots.

A high rate of success

The success rate has been commonly stated in Forex trading and is considered to be one of the most critical metrics for the assessment of Forex trading applications. Forex Day Trading in 2011 shows that the performance rate depends on the overall volume of money and the number of orders for profits.

The growing use of trading machines, particularly algorithmic trading, provides significant benefits to trading technology and transaction efficiency. Concerning the performance of Forex Robot trading, it is believed that a profitable program would have a high proportion of viable orders rather than just trading prices. Nevertheless, in the field of adaptation,

It was suggested that the Forex Robot should place a limit for each transaction and that the overall account could be profitable, but not based on a useful transaction percentage.

Low-risk

The high risk of Forex trading may not be acceptable for all traders. The Foreign Exchange Market Explained claims that any Forex trader has his / her trading strategies that can help him/her enter and leave Forex trading and evaluate the anticipated movements. A sophisticated trading robot developed by seasoned traders could reduce the risks for new traders. Nevertheless, only the most professional traders cannot predict the possible developments of the Forex market. For any trade-in Forex robot trading, a minimum loss should be given. Low risk is, therefore, an essential requirement in the assessment of Forex trading robots.

WHY EA / ROBOT IS USED IN FOREX

In the field of foreign exchange trading, an expert advisor (EA) is a software program that advises you when to sell/buy or also instantly initiate and implement trades in compliance with programmed orders.

Expert advisors are most commonly used on the MetaTrader 4 or 5 Forex trading sites. You can use an established EA or build your own EA depending on the trading criteria that you want. Such EAs are written in the programming language MetaQuotes Language (MQL).

Advantages of the Forex robot

Forex markets are available around the world 24 hours a day and seven days a week. Using a professional broker, or a related trading device called a Forex robot, to conduct business in your absence, helps you to take advantage of trading opportunities when you’re working, resting, or otherwise occupied.

The use of the EA also eliminates the sentimental aspect of the trading. Your anxiety or envy does not play a part in whether or not you want to respond to trading signals; the EA does perform business based on your orders without thinking whether to expend profit or manage a loss.

If Forex trading is the key revenue source, having an EA will reduce the stress level and make a possibly emotionally and mentally stressful and time-consuming business even less so.

On a similar note, an EA or a Forex Robot will weigh far more factors at the same time than you would have wanted to wrap your mind around. And at the same time, these variables can be listed for various currency pairs. You can’t, no matter how smart you are.

The significance of Monitoring and Analysis

Whether you’re using someone else’s EA or making your own, it’s essential to check it over a variety of time frames in a trial account — one that doesn’t place actual money at risk — and see if it functions with you. You can note, for example, that it fits best for individual currency pairs, but not for others.

When you are using an EA that you have programmed, be ready to fine-tune variables from time to time. When consumer dynamics change, the software can need to change with them.

If you are using an EA from another firm or person, note that the currency market is mostly unregulated, which makes it easy for scammers. Beware of EA developers, of course, who guarantee excessively high returns. We also know that some scammers recognize that overpromising is a red flag, and an EA supplier who attempts to find a balance between hope and reputation can also be a scammer.

Once you agree to some professional counselor, do your homework, above all, and keep your hopes reasonable. There are few excellent EAs out there, and some traders make year-over-year profits with an EA or computer that trades automatically. Still, their average percentage returns are likely to be at best in high single or low double digits.

If you need help choosing the right Forex robot for your trading, then feel free to check our post on the best Forex robots.