FOREX MARKET HOURS WHICH FOREX MARKET IS OPEN/CLOSED NOW? Before we look at the trending…

What Is Forex Commission?

HOW MUCH DOES A FOREX TRADE COST?

It would require money to make money. You’re going to need trading capital. Everybody knows that, but how much does it take to get involved in Forex Commission trading? The response depends mostly on how you handle your new start-up business.

Next, remember how you’re going to be trained. There are many different approaches to learning how to trade: seminars, guides, on your own, or any combination of the three. While there are several workshops and instructors out there able to teach Forex trading, many will charge a fee you may called as Forex Commission.

The advantage of this path is that a well-trained class or a great mentor will dramatically shorten your learning process and get you on your way to success in a much shorter time relative to doing everything on your own.

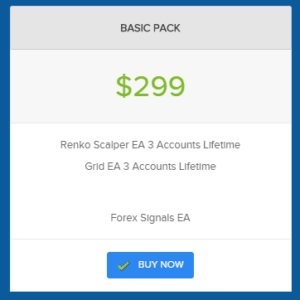

The downside is the upfront trading costs of these services, which can vary from a few hundred to a few thousand dollars, probably depends on which program you are going for.

For many of those new to trading, there is no capital (money) required to purchase these services. For those of you who are unable or unable to pay for tuition, the good news is that most of the knowledge you need to get started can be accessed for FREE on the internet via directories, traders, articles, and websites As long as you are diligent and laser-focused on business research, the possibility of success increase exponentially. You’ve got to be an overly enthusiastic guy. If you don’t, you’ll end up in a poor house.

Second, would the market approach require special tools, such as news feeds or charting software?

As a professional Forex Commission trader, most of the charting bundles that come with your broker’s trading platforms are adequate (and some are very successful ones). For those that require special indicators or improved features, higher-end charting apps will start at about $100 a month. You might be a key trader, and you need the news a millisecond, or even before it happens (that wouldn’t be nice!). Yeah, instant news updates range from a couple hundred to a few thousand dollars a month.

Again, you can get a free news stream from your Forex trader, but for others, the extra second or two can be the distinction between lucrative or unprofitable trading.

Finally, to deal, you need money/capital/funds. Retail Forex brokers deliver minimum deposits as low as $25, but it doesn’t mean you can join immediately!

Then how much of the financial capital do you need?

Let’s be frank here, if you’re disciplined and follow sound risk management strategies, and stick to selling micro-lots, then you should potentially start money of sale from $5k to $10k. It is common knowledge that most companies fail due to undercapitalization, particularly in Forex Commission trading.

Can I Trade With $10?

Yeah, it’s easy to start selling Forex Commission with a $10 account and even less than that. Any Forex brokers have minimum account specifications of up to $ 1,000. Any of them are as cheap as $5. Become acquainted with Forex Commission dealing, and study prospective brokers first to see which ones make deposits of $10 or less. These are the main things to remember when dealing for a $10 account:

- Size of the lot

You need to have the ability to trade micro and mini-batches if you are willing to deposit a small amount, i.e., $10, into your trading account. The regular lot in Forex Commission is $100,000, while the mini lot and the micro-lots are $10,000 and $1,000, respectively.

- Leverage

Trade leveraging applies to a facility that helps you to gain a more significant trading advantage than the actual dollar amount invested in your portfolio. For example, if you deposit $1,000 into your account and are willing to purchase a regular batch of New Zealand Dollar vs. US Dollar currency pairs – a regular batch of $100,000 – then you’re expected to use 1:100 leverage. Broker has its potential leverage, with some offers of 1:10 and some as high as 1:1,000. While this looks like a win-win scenario for a trader, there are pros and cons of leverage on your trading portfolio.

Capital Instance for $10 account

- $10 account

Suppose you’ve got a $100 budget. You’re going to reduce the probability of any contract to $0.1 (1 percent of $10).

If you trade in EUR / USD, buy or sell a micro sum, your stop-loss order will be within 10 pips of your entry price. Since each pip is worth $0.01, if the stop loss is 11 pips down, the cost is $1.010 (11 x $0.01), which is more costly than you anticipate.

You can see how starting a $10 account is seriously restricting how much you can exchange. In comparison, if you gamble a certain dollar amount, you can only make a slight profit by chance if you sell correctly. You will need more capital to make a better profit — and potentially produce a decent amount of return from your trading activities.

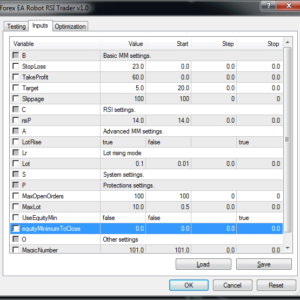

WHAT IS COMMISSION IN MT4?

When you deal in Forex markets even as a beginner Forex trader, you don’t pay a fee; usually, the fee is incorporated into the spread. In other terms, the Forex broker would marginally increase his spreads to pay for his expenses and fees. Commissions vary from Forex Commission broker to broker.

For experienced traders, you can submit a raw spread account and agree on a fee separately. What this means is that the trader can sell the raw spread from the market and brokers charge a fee on each sale.

There are two forms of accounts available for Key Markets:

Standard account MT4: This account does not include fees, but a fixed cost of 1 pip is applied to the spread of the market. It is perfect for traders who prefer to learn about pips while they learn about spreads.

MT4 Pro account: this account applies a commission to each lot exchanged (equivalent to a base value of 100,000). The commission used is equal to €3 per trade. The round trip (open / close) is equal to 6 Euros. In USD, the difference is $4 per transaction and $8 per round trip. The fee is translated to the basic currency of your account. Commissions refer to FX currency pairs and commodities such as silver and gold. In the CFDs, both contracts are part of the array.

IS FOREX COMMISSION A PYRAMID SCHEME?

Forex trade does not pursue a pyramid structure. It is likely because traders have absolute power over the selling and buying button as per their choice. You will close a trade according to your desires, and you cannot enlist anyone in your company as the main aim of your company. There is no Forex pyramid scam if you use controlled brokers. Forex trading is a legal business, the same as investing in securities.

Unfortunately, many people appear to make ambiguous and misleading theories about Forex Commission. In reality, some people may even suggest that Forex Commission trading is a pyramid scheme. But in fact, this isn’t the right thing to do! Forex trade never fits the pyramid structure. The best thing is that Forex trading gives you absolute power so that you can press the buy or sell switch as per your particular opinion. You have the complete luxury of closing the trade you like as per your decision. As a dealer, you can do a detailed review of the available Forex signals and select the most lucrative exchange that will help you earn profits in no time.