FOREX MARKET HOURS WHICH FOREX MARKET IS OPEN/CLOSED NOW? Before we look at the trending…

Forex basic terms for beginners

The Forex market

Welcome to the Forex trading world. Forex is the biggest market in the world. It’s traders exchange $4 trillion every day, but is Forex Terms a favorable market for you? Forex (FX) is the marketplace where different national currencies are traded. The Forex market is the world’s largest, most liquid market, with trillions of dollars bought and sold every day. In order to master something, we need to know the basic terms like if one wants to be an expert in Forex trading, then the knowledge of Forex terms is a must. So, let’s learn about the basic Forex terms.

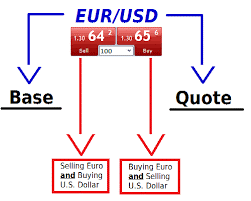

Currency Pair

It is a quotation for one unit of a currency against another currency unit.

It is a quotation for one unit of a currency against another currency unit.

For instance, the euro and the US dollar combined make up the EUR / USD currency pair. The first currency (EUR) is the base currency, and the second currency (the US dollar) is the quote currency.

Exchange Rate of Forex Terms

This is the rate at which one currency is exchanged for another. The exchange rate tells you how much of the quotation currency you need if you’d like to buy 1 unit of the base currency.

Example: EUR/USD = EUR 1.3117. This means that 1 euro (base currency) is equivalent to 1.3117 US dollars (basic currency).

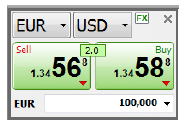

Quote

This is a retail price that often consists of two figures: the first figure is the bid/sell price, and the second is the ask/buy price. (e.g., 1.23457/1.12346) for example.

Asking Price

Often known as the price of the deal, the selling price is the price evident on the right side of the quote. That is the quality at which you can buy a base currency.

For example, if the quote on the EUR / USD currency pair is 1.1964/66, that means you can buy 1 euro for 1.1966 US dollars.

For example, if the quote on the EUR / USD currency pair is 1.1964/66, that means you can buy 1 euro for 1.1966 US dollars.

Price of Bid

That is the price at which a currency pair may be exchanged.

For instance, if EUR / USD is quoted at 1.4567/1.4571, the first number is the bid price at which the currency pair will be exchanged.

The bid is often less than ask. So the difference between the bid and the asking price is the spread.

Spread

It is the difference in the pips between the asking price and the bid price. The difference reflects the cost of the brokerage service and substitutes the transaction fees.

Pip

A Pip is the smallest increase/decrease in the price of a given exchange rate.

Are you a visual person, huh? Here’s an instance: if the currency pair EUR / USD goes from 1.2550 to 1.2551, that’s a 1-pip move, or a move from 1.2550 to 1.2555 is a 5-pip move. As you will see, the pip is the final decimal point.

Both currency pairs have four decimal points – the Japanese yen is the unique one out. Pairs that contain JPY have just 2 decimal points (e.g., USD / JPY=86.51).

Lot

Forex Terms is traded in quantities called lots. One standard lot > has 100,000 base currency units, while a micro lot has 1,000 units.

For instance, if you buy 1 standard lot of EUR / USD at 1.325, you buy 100,000 Euros and sell 131,250 US Dollars. Similarly, when you sell 1 micro lot of EUR / USD at 1.3121, you sell 1,000 Euros, and you buy 1,313. US dollars.

Pip Value

The Pip Value indicates the value of 1 pip. The pip value adjusts according to market fluctuations. So it’s essential to keep an eye on the currency pair(s) you’re trading and how the market behaves.

Now let’s talk about what you’ve heard about the pips! To take advantage of the pips and see a substantial increase/decrease in profit, you would need to trade significant amounts. Suppose that your account currency is USD, and you want to exchange 1 standard lot of USD / JPY. How much is 1 pip worth per $100,000 USD / JPY currency pair?

The formula for the estimation is as follows:

Amount x 1 pip = 100,000 x 0.01 JPY = JPY 1,000 If USD / JPY = 130.46, then JPY 1,000 = USD 1,000/130.46 = USD 7.7 Hence, the value of 1 pip in USDJPY is equal to: (1 pip, with correct decimal positioning x amount / exchange rate)

Here’s another example of this:

In the EUR / USD set, the difference between 1.3151 and 1.3152 is 1 pip, so 1 pip is 0.0001 USD. How much US dollar is the worth of this $1,000 micro-batch movement? $1,000 x $0.0001 USD = $1 USD.

Leverage

Strictly speaking, via leverage, the Forex Terms broker lends you funds so that you can exchange larger lots:

Leverage depends on the broker and its versatility. Around the same time, the leverage varies: it can be 100:1, 200:1, or even 500:1. Note that with leverage, you can use $1,000 to trade $10,000 ($1,000×100) or $500,000 ($1,000×500) or $200,000 ($1,000×200).

Stop-entry Order

This is an order you give to buy above the current price or sell order below the current price because you believe the market would stay in the same direction. It’s the inverse of a limit order.

Suppose the EUR / USD is priced at 1.34. You want to go for a buy (i.e., put a buy order on this currency pair) if the price is 1.36, then you place a stop order to buy at 1.36. This command is referred to as a stop-entry signal.

Take Profit Order (TP)

It is an order that shuts your trade as long as it has achieved a certain level of profit.

Stop-Loss Orders (SL)

It’s an instruction to stop the trade as soon as it reaches a certain point of loss. Through this approach, you can reduce your risk and prevent wasting any of your money.

Market Order / Order of Entry

It is an offer to purchase or sell the currency at the current rate.

Open Order

This is an order to buy/sell a financial asset (e.g., Forex, bonds, or goods such as oil, gold, silver, etc.) that must stay open until you close it, or you let your broker shut it down for you (e.g., through telephone trading).

Limit Order

It is an order placed apart from the current market value.

Assuming the EUR / USD is being traded at 1.34. You want to go short (place a selling order on this currency pair) because the price is 1.36, then you put an order for the price of 1.36. This instruction is considered a limit order. Therefore the order should be placed until the price hits the mark of 1.35. The buy limit order is always set below the current rate, while the selling limit order is always placed above the current price.

Long position

Once you enter a long position, you’re buying a base currency.

Suppose you pick a pair of EUR / USD. You expect the EUR to rise relative to the USD, and you can buy the EUR and make a profit from its gain in value.

Short position

Once you reach a short position, you’re selling a base currency. If you chose the EUR / USD pair again, except this time you expect the EUR to fall relative to the USD, you can sell the EUR and make a profit from its decrease in value.

Close Trade

When you reach a long (buying) position and the base currency rate has increased, you want to make a return. You have to close the place to do so.

Thank you for reading our Forex Terms guide. We hope you enjoyed this short article, if so, then will enjoy our other articles such as The best MT4 Software.

Don’t forget to share these basic Forex terms with your friends and family!